Inflation has been a recurring economic phenomenon throughout history, with some countries experiencing extreme cases that leave a lasting impact on their societies. Two such examples are Germany in the early 1920s and Zimbabwe in the late 2000s. These nations witnessed astronomical levels of inflation, forcing their citizens to face unprecedented challenges while attempting to purchase basic necessities. In this article, we will delve into the hyperinflationary periods in Germany and Zimbabwe, highlighting the shocking scenarios where individuals had to carry wheelbarrows of money and pay trillions of dollars for a loaf of bread, respectively.

Germany’s Inflation Nightmare

During the Weimar Republic era in Germany (1919-1933), a devastating hyperinflationary episode unfolded. The country, burdened with significant war debts and reparation payments after World War I, resorted to excessive money printing to meet its obligations. The result was a catastrophic devaluation of the German mark.

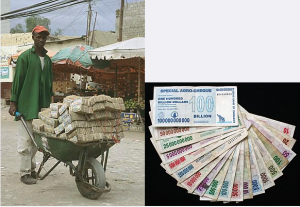

At its peak in November 1923, the inflation rate in Germany soared to an unimaginable 29,500% per month. The hyperinflation led to a rapid erosion of the currency’s value, leaving citizens bewildered as prices skyrocketed daily. To keep up with the rising costs, people were forced to carry wheelbarrows filled with stacks of nearly worthless banknotes just to buy everyday items.

Imagine a scenario where a loaf of bread that cost around 250 marks at the beginning of 1923 surged to a staggering 200 billion marks within a year. The once-stable German currency became virtually worthless, resulting in social unrest and economic instability.

Zimbabwe’s Trillion-Dollar Bread

Fast forward to the late 2000s, when Zimbabwe faced one of the most severe hyperinflation crises in modern history. Under the leadership of President Robert Mugabe, the government embarked on reckless economic policies, including rampant money printing and land seizures, which crippled the country’s agricultural sector.

The hyperinflation crisis peaked around 2008-2009, with Zimbabwe’s inflation rate surpassing astronomical figures. In this desperate period, citizens faced a shocking reality where they needed trillions of Zimbabwean dollars to purchase even the most basic commodities. The Zimbabwean dollar became practically worthless, and the country abandoned its currency in 2009, adopting foreign currencies instead.

Against this backdrop, a loaf of bread, which had previously been affordable for most citizens, required prices to be expressed in trillions of Zimbabwean dollars. People’s life savings were wiped out, and the economy experienced a catastrophic collapse, leaving many struggling to feed their families.

Comparing the Tragic Tales

Although Germany’s and Zimbabwe’s hyperinflationary experiences occurred in different eras and geopolitical contexts, they share striking similarities in their impact on everyday life. Both nations experienced a rapid devaluation of their currencies, rendering them practically worthless. The consequence was a surreal scenario where citizens required enormous sums of money to purchase even the most basic necessities.

While Germany eventually managed to stabilize its economy and rebuild, Zimbabwe’s road to recovery has been longer and more complex. The scars left by hyperinflation run deep, and the country continues to grapple with economic challenges and the consequences of the crisis.

The hyperinflationary episodes witnessed in Germany and Zimbabwe represent dark chapters in their respective histories. The images of wheelbarrows full of money and bread priced in trillions serve as vivid reminders of the devastating consequences of unchecked inflation. These episodes underline the importance of sound economic policies, responsible governance, and maintaining a stable monetary system to prevent such calamities from recurring.